Insights on family finances and surrogacy with Braiden Shaw

In this month’s Insights Series, we spoke with Braiden Shaw, a financial strategist, parent, and advocate for intentional money management. Braiden shares his family’s surrogacy journey, the lessons they’ve learned along the way, and his approach to setting up both parents and children for financial success. He also shares practical tips on managing the high costs of assisted reproduction, budgeting for new parents, and starting early to teach kids about money. Discover Braiden’s inspiring story and get actionable advice for navigating both family life and finances with confidence.

What has been most surprising about your family’s surrogacy journey that you'd want to share with other families?

Going into surrogacy, we knew it would not be the same as a normal pregnancy journey. We had a lot of fears around connecting with the surrogate, the baby, and having extended family also feel connected. It was surprising how easily we bonded with the surrogate and how much we came to appreciate her. She will always be welcome into our daughter’s life and hope that she will continue to be a part of it. We also had no problem loving our new baby and she has just been loved on by those in our community.

What words of encouragement would you give to intended parents who are considering starting their journey with surrogacy?

If you are contemplating surrogacy, most likely you have spent years of disappointment and a lot of money to get to this point. Take it one day at a time. It is a lot of paperwork, a lot more money, and a lot of waiting. We had a great agency that walked us through the steps one at a time and helped us to just keep moving forward. Our first embryo did not take, and it felt heavy for us and the surrogate. We feel very blessed that the second attempt did and understand that it can seem so overwhelming when there is so much to do and yet so much time to wait.

You offer incredible financial tips on your platforms. Can you share three pieces of advice for other parents who are concerned about managing the high cost of assisted reproduction?

Treat it like a financial goal and know how much you will need and what your options are. Surrogacy can be very expensive, and you should ask your clinic early for a breakdown of the cost. Be prepared to set aside an amount every month to just go into a separate account. On top of that you may use several different financing options to supplement. There are special loan options (personal loans, HELOC, 401(k) loans, other specific fertility loans), look to see if you have any employer benefits, HSA funds, qualify for grants, and I have seen many find success with crowdfunding from family and friends.

Look at different agencies. Compare costs and if there is the ability to negotiate. If you feel confident enough, an independent surrogacy journey can save you thousands.

Insurance. While not always possible, finding a surrogate that has surrogate friendly insurance will save you a lot of money.

What is the number one thing you wish every new or expecting parent would do to optimize how they manage their finances?

Becoming a new parent can seem very expensive. Make a budget especially for baby-related items and stick to it. If they reach out to me, I’m more than happy to send them the budget sheet I use. After you have a budget, look at your debt management, survival fund, and set up any accounts you need to (HYSA, retirement, crypto, Brokerage, and trust).

For new or expecting parents looking to get into investing, are there any must-know resources you would suggest?

I love books. A few of my favorites are- 'Rich Dad, Poor Dad', 'Atomic Habits', and 'The Millionaire Next Door'. I also am always willing to help, If you have a question and would like to message me on Instagram where I have a lot of videos on how to set up finances and invest.

What practical tips do you have for parents who are looking to start early to help set their kids up for financial success?

Start early. The most important thing when investing is time. You can open up a 529 plan as soon as you have a ssn number and start investing for them. My Mother-in-Law has taken to gifting them money into my kids 529 each year and then giving smaller physical presents. I think it’s also so important to talk about money in the home and model that it is a tool to be used.

What is your family’s favorite splurge that you would recommend to other new parents?

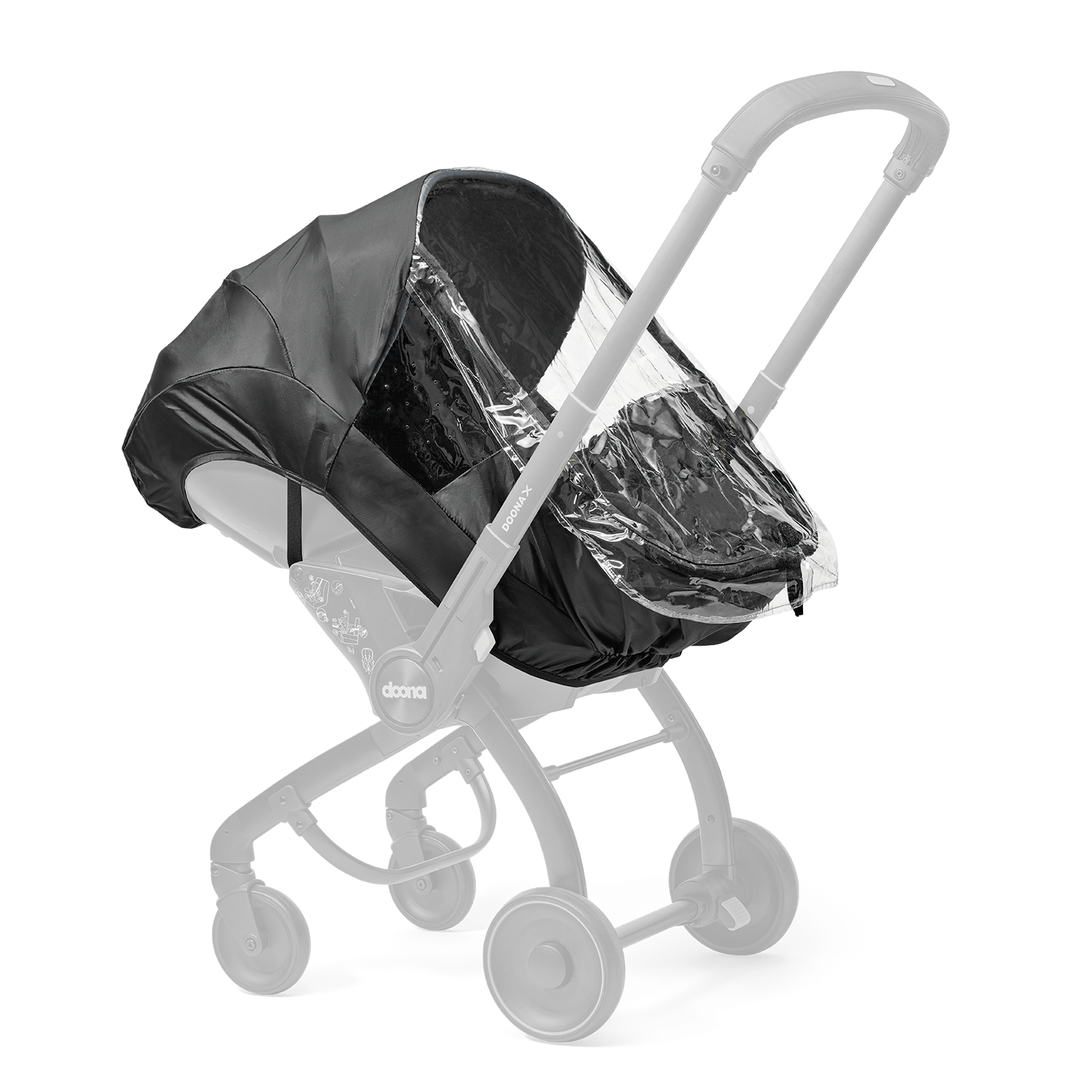

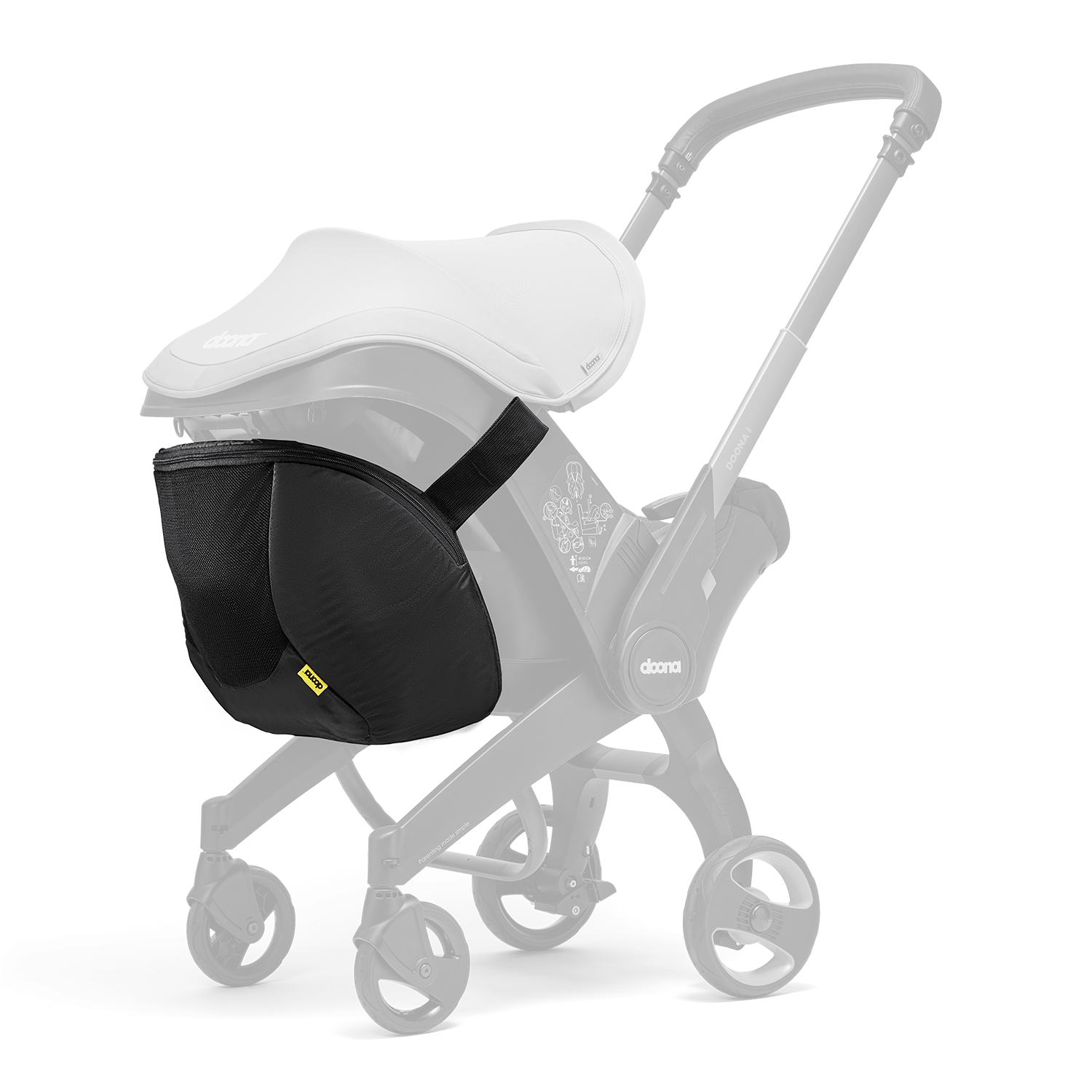

Honestly, the Doona car seat was such a nice splurge when we were first new parents. It has traveled all over with us and now makes the ability to go out with two kids and a baby so much easier. In addition to that, we love our bottle maker for those first few months. It sat right next to the bassinet and made night feedings a breeze.

What financial values are most important to you to instill in your little ones as they grow?

I want my children to know that money is a tool and not something that should ever control emotions. I want them to always be grateful for what they have and know, most importantly, how to use it to bless others.

Braiden Shaw is a financial strategist, content creator, and dad who is passionate about helping families build strong financial foundations. He shares practical guidance on budgeting, investing, and navigating the costs of parenthood. You can stay connected with Braiden through his Instagram @yourfriendbraiden for approachable tips and financial education for parents.

At Doona, we’re committed to making parenting simple for every family. That's why we’ve created our innovative and revolutionary Doona Car Seat and Stroller, transforming from car seat to a stroller in seconds; and Liki Trike — the most compact folding toddler trike on the market that grows alongside your toddler from 10-36 months.